Have you ever found yourself stuck in long queues at public transportation stations just to top up your travel card? Or maybe you've been frustrated trying to figure out how to pay for services using unfamiliar systems while traveling abroad? Well, say goodbye to all that hassle because metro payment solutions are here to revolutionize the way we handle transactions on public transport. From contactless cards to mobile apps, the world of metro payments is making life easier for millions of people every day. In this article, we'll dive deep into everything you need to know about metro payment systems, their benefits, and how they're shaping the future of urban mobility.

Imagine a world where you can breeze through turnstiles without fumbling for cash or cards. A world where your travel expenses are automatically deducted from your account, leaving you with one less thing to worry about. That's exactly what modern metro payment systems offer. They're not just convenient; they're also secure, efficient, and eco-friendly. Whether you're a daily commuter or an occasional traveler, understanding how these systems work can save you time, money, and stress.

But here's the thing – with so many options available, it can be overwhelming to figure out which system is right for you. That's why we've put together this comprehensive guide to help you navigate the complex world of metro payments. We'll cover everything from the basics of how these systems work to the latest innovations in the industry. So grab a coffee, get comfortable, and let's dive in!

Read also:Gail Ogrady The Remarkable Journey Of A True Hollywood Legend

What Exactly Are Metro Payments?

Metro payments refer to the various methods used to pay for public transportation services, particularly on metro or subway systems. These systems have evolved dramatically over the years, moving from traditional cash and paper tickets to more advanced digital solutions. Today, metro payments encompass a wide range of technologies, including contactless cards, mobile apps, and even biometric authentication. The goal is simple: to make the payment process faster, easier, and more secure for everyone involved.

Think about it – no more worrying about losing your ticket or running out of change. With metro payment systems, you can simply tap your card or phone and go. It's like having a personal assistant who takes care of all your travel expenses for you. And the best part? Many of these systems are integrated with other forms of public transportation, allowing you to seamlessly switch between buses, trains, and even bikes without needing separate tickets.

Key Features of Modern Metro Payment Systems

- Contactless Payments: Tap your card or phone on a reader and you're good to go. No need to insert anything or wait for receipts.

- Mobile Apps: Download an app, link it to your bank account, and start paying for your journeys with just a few taps.

- Auto-Top-Up: Set up automatic top-ups so you never run out of funds when you need them most.

- Real-Time Tracking: Many apps allow you to track your journey in real-time, giving you updates on delays, alternative routes, and estimated arrival times.

- Multi-Modal Integration: Use the same payment method for different modes of transport, such as buses, trains, and bike-sharing services.

The Evolution of Metro Payment Systems

Believe it or not, metro payment systems have come a long way since the days of paper tickets and token machines. In the early days, passengers had to purchase physical tickets for each journey, often in cash. This process was slow, cumbersome, and prone to errors. But as technology advanced, so did the ways we pay for public transportation.

The introduction of magnetic stripe cards in the 1980s was a game-changer. These cards allowed passengers to load funds onto their travel cards, eliminating the need to carry cash. However, they still required manual insertion into ticket machines, which could be slow during peak hours. It wasn't until the late 1990s and early 2000s that contactless payment systems began to emerge, revolutionizing the way we travel.

Why Are Metro Payments Important?

So why should you care about metro payments? Well, for starters, they make your daily commute faster and more efficient. No more waiting in line to buy tickets or worrying about having the right change. But the benefits don't stop there. Metro payment systems also promote financial inclusion by allowing people without bank accounts to access public transportation through prepaid cards or mobile wallets.

From an environmental perspective, digital payment systems help reduce paper waste by eliminating the need for physical tickets. They also encourage more people to use public transportation, which can help reduce traffic congestion and lower carbon emissions. In short, metro payments aren't just about convenience – they're about creating a more sustainable and inclusive future for everyone.

Read also:Chamath Palihapitiya Wife The Woman Behind The Visionary Tech Tycoon

How Do Metro Payment Systems Work?

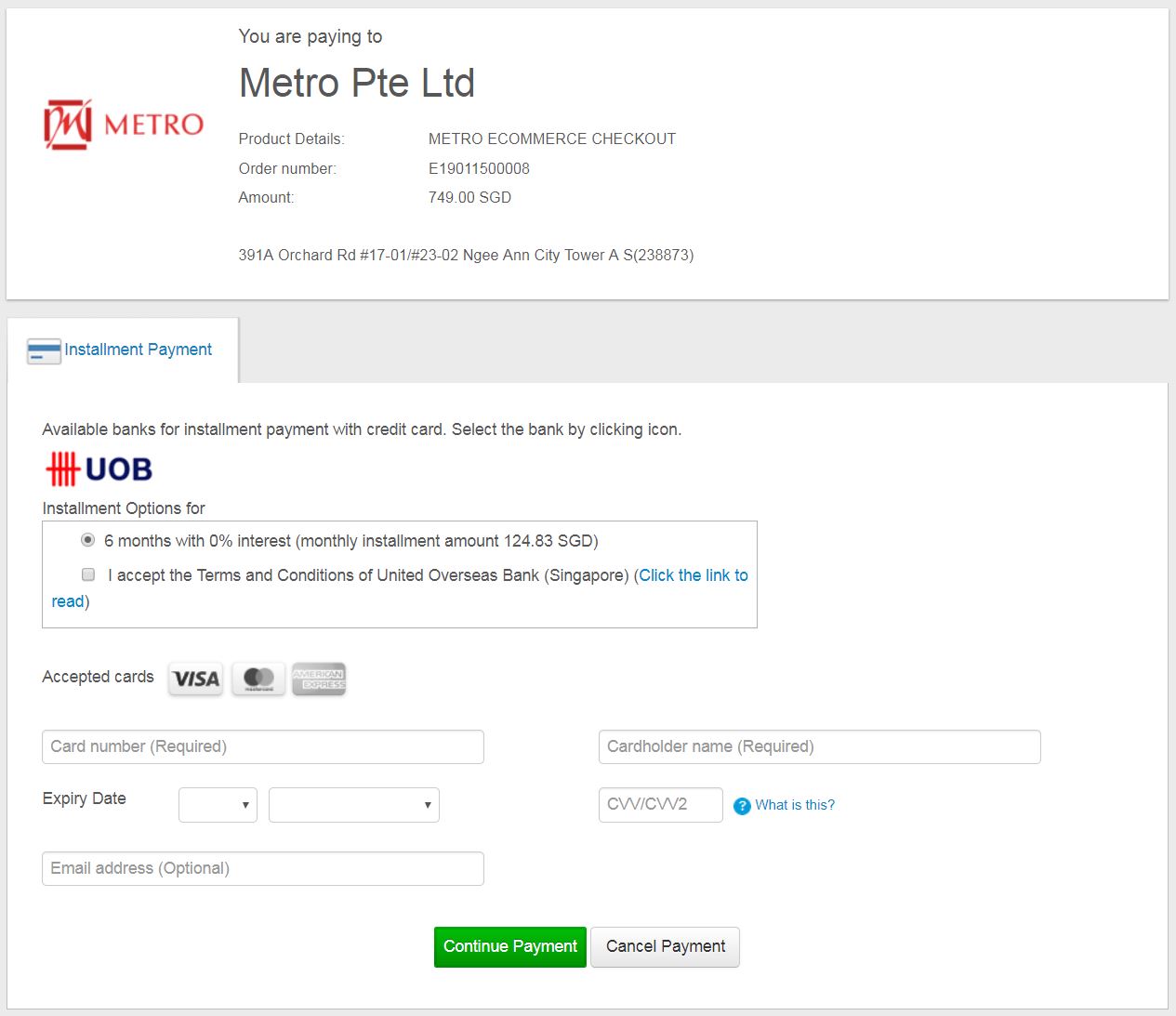

At its core, a metro payment system works by linking a payment method – such as a credit card, debit card, or mobile wallet – to a travel account. When you tap your card or phone on a reader at a station, the system automatically deducts the cost of your journey from your account. The process is fast, secure, and virtually seamless, allowing you to focus on more important things, like catching your train on time.

But what happens behind the scenes? When you tap your card or phone, the payment terminal sends a request to the payment processor to verify your account and deduct the appropriate amount. This entire process takes just a few seconds, ensuring that you're not held up at the turnstile. Many systems also include fraud detection measures to protect your account from unauthorized transactions.

Common Technologies Used in Metro Payments

- RFID (Radio-Frequency Identification): Used in contactless cards and tags to transmit data wirelessly.

- NFC (Near Field Communication): Enables communication between devices, such as smartphones and payment terminals, when they're close to each other.

- QR Codes: Scannable codes that can be used to make payments or access services through mobile apps.

- Biometric Authentication: Emerging technology that uses fingerprints, facial recognition, or other biometric data to verify your identity.

Benefits of Using Metro Payment Systems

Now that we've covered the basics, let's talk about why you should consider switching to a metro payment system. The benefits are numerous, and they extend beyond just convenience. Here are some of the key advantages:

- Time-Saving: No more waiting in line to buy tickets or topping up your travel card manually.

- Cost-Effective: Many systems offer discounts or promotions for frequent users, helping you save money in the long run.

- Security: Digital payment systems are much harder to counterfeit than physical tickets, reducing the risk of fraud.

- Convenience: With mobile apps, you can manage your travel account, view transaction history, and receive updates on the go.

- Environmental Impact: By reducing paper waste and encouraging public transportation use, metro payment systems contribute to a more sustainable future.

Challenges and Limitations

Of course, no system is perfect, and metro payment systems are no exception. Some of the challenges include:

- Technical Issues: Payment terminals can malfunction, leading to delays or incorrect charges.

- Compatibility: Not all systems are compatible with every payment method, which can cause confusion for travelers.

- Data Privacy: With so much personal and financial information being stored, there's always a risk of data breaches.

- Accessibility: Some systems may not be accessible to people with disabilities or those who don't own smartphones.

Best Practices for Using Metro Payment Systems

If you're ready to make the switch to a metro payment system, here are some tips to help you get the most out of it:

- Choose the Right Payment Method: Consider factors like convenience, security, and cost when selecting a payment option.

- Set Up Auto-Top-Up: Ensure you never run out of funds by setting up automatic top-ups on your travel account.

- Monitor Your Transactions: Regularly check your transaction history to ensure everything is accurate and catch any potential issues early.

- Stay Updated: Keep an eye on system updates, promotions, and changes to terms and conditions to make the most of your experience.

Security Measures to Protect Your Account

When it comes to digital payments, security is always a top priority. Here are some steps you can take to protect your metro payment account:

- Use Strong Passwords: Make sure your account is protected with a unique, complex password.

- Enable Two-Factor Authentication: Add an extra layer of security by requiring a second form of verification for sensitive actions.

- Keep Your Devices Secure: Use antivirus software and regularly update your operating system to protect against malware and hacking attempts.

- Report Suspicious Activity: If you notice any unauthorized transactions, contact the payment provider immediately to resolve the issue.

The Future of Metro Payments

As technology continues to evolve, so too will metro payment systems. We're already seeing the emergence of new innovations, such as biometric authentication and blockchain-based payment solutions. These technologies promise to make transactions even faster, more secure, and more transparent in the years to come.

But it's not just about the technology – it's also about how these systems are integrated into our daily lives. Imagine a future where your metro payment system is seamlessly linked to your calendar, automatically adjusting your travel plans based on your schedule. Or a world where you can pay for your entire commute – from train to bike to bus – with a single tap of your phone. The possibilities are endless, and the future of metro payments looks brighter than ever.

Emerging Trends in Metro Payment Technology

- Biometric Payments: Using fingerprints, facial recognition, or other biometric data to verify your identity and authorize transactions.

- Blockchain Technology: Providing a secure, transparent, and decentralized way to manage payments and transactions.

- AI-Powered Systems: Using artificial intelligence to predict travel patterns, optimize routes, and enhance the overall user experience.

- Smart Cities Integration: Linking metro payment systems with other urban services, such as parking, tolls, and public Wi-Fi.

Conclusion

As we've seen, metro payment systems are more than just a convenient way to pay for public transportation. They're transforming the way we travel, work, and live in cities around the world. From contactless cards to mobile apps, these systems offer numerous benefits, including time savings, cost-effectiveness, and environmental impact. However, it's important to be aware of the challenges and limitations, and to take steps to protect your account and personal information.

So what's next? If you're ready to embrace the future of metro payments, start by exploring the options available in your city. Whether you choose a contactless card, a mobile app, or one of the emerging technologies we discussed, the key is to find a system that works for you and your lifestyle. And remember, the more you use these systems, the more you'll contribute to a smarter, more sustainable urban environment.

Have any questions or thoughts about metro payments? Leave a comment below and let's continue the conversation. And if you found this article helpful, don't forget to share it with your friends and family. Together, we can make commuting a little easier for everyone!

Table of Contents

- What Exactly Are Metro Payments?

- The Evolution of Metro Payment Systems

- How Do Metro Payment Systems Work?

- Benefits of Using Metro Payment Systems

- Best Practices for Using Metro Payment Systems

- The Future of Metro Payments

- Conclusion